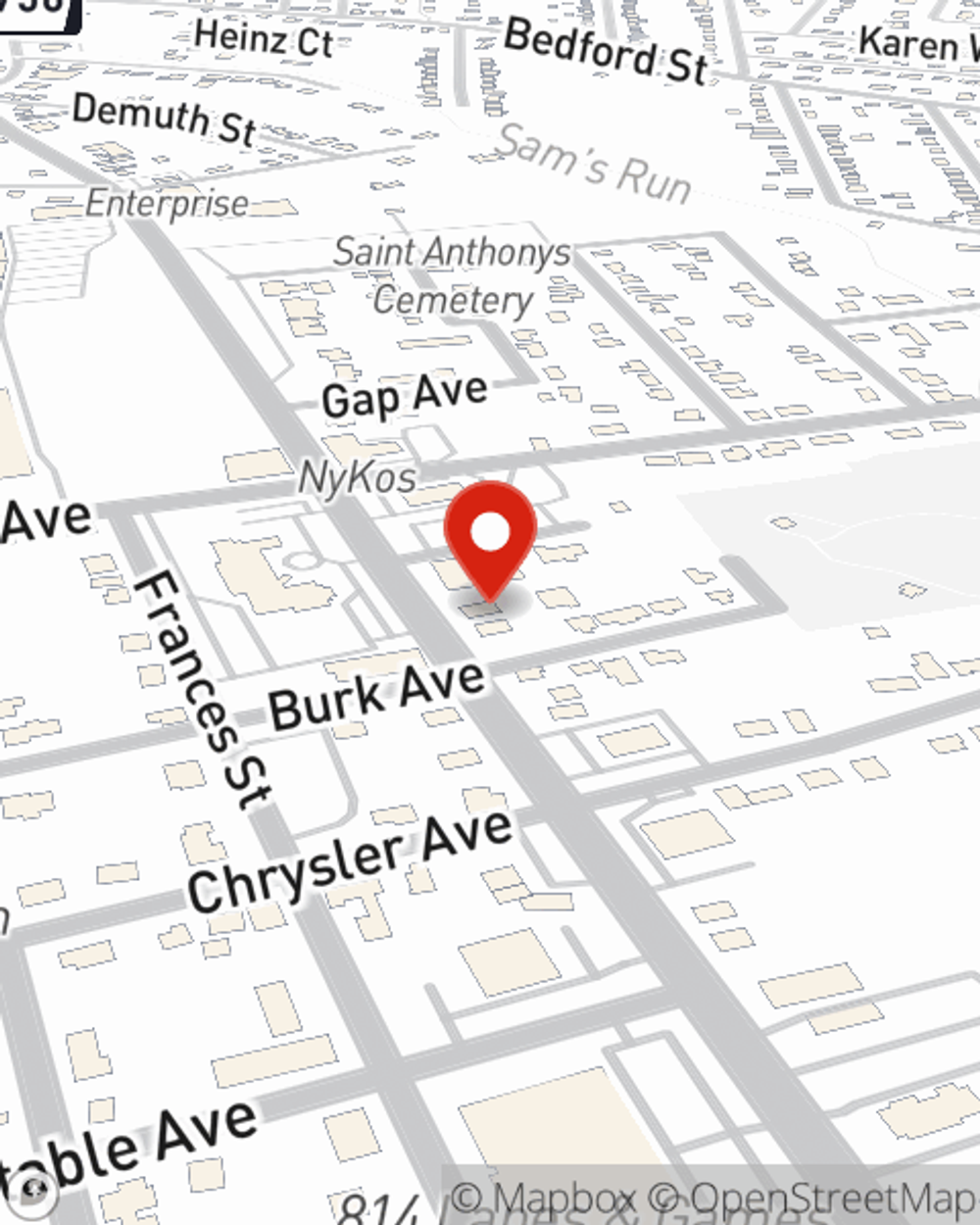

Business Insurance in and around Johnstown

Get your Johnstown business covered, right here!

Helping insure small businesses since 1935

Help Protect Your Business With State Farm.

Whether you own a a veterinarian, a cosmetic store, or a bakery, State Farm has small business protection that can help. That way, amid all the different decisions and moving pieces, you can focus on making this adventure a success.

Get your Johnstown business covered, right here!

Helping insure small businesses since 1935

Cover Your Business Assets

Your business is unique and faces a different set of challenges. Whether you are growing a pottery shop or a clothing store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your location, you may need more than just business property insurance. State Farm Agent Paul Hope can help with business continuity plans as well as professional liability insurance.

As a small business owner as well, agent Paul Hope understands that there is a lot on your plate. Visit Paul Hope today to chat about your options.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Paul Hope

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.